When looking for ways to safely and wisely invest your money, there are often two main suggestions: Real estate and the stock market. Real estate has the benefit of intrinsic physical value, as you can actually live, work, or at least store things inside it. You can also rent it out, and collect regular income, or wait for it to appreciate and sell for a profit. The stock market has a lower financial barrier to entry but can be a lot more complicated. Additionally, if you think real estate is a volatile and unpredictable market, stocks are subject to even more influences, and can shift with the wind in ways that make house prices look stable.

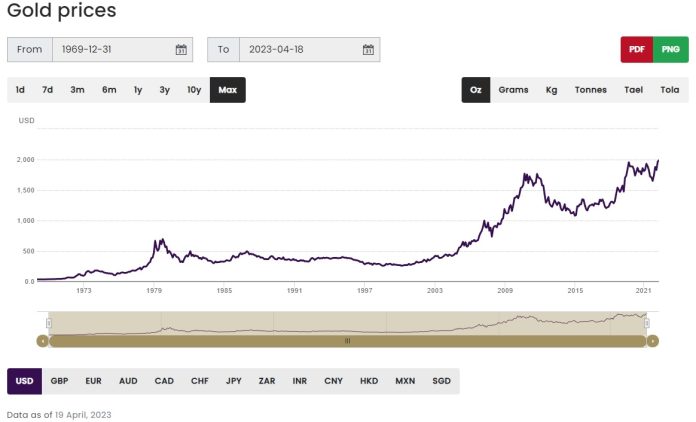

What about an option that not only has increased in value steadily since the mid-20th century, is easy to invest in, has a low financial barrier to entry, and doesn’t require a business degree to grasp? Gold –and other precious metals– remains an understood and broadly accepted currency across the world, as it has been for centuries. It has both fiat –in its historical role as a government endorsed currency– and practical –industrial and manufacturing applications– value giving it positive aspects of both money and durable goods.

Gold and other precious metals fluctuate in value of course, as anything does, but gold especially doesn’t follow the same patterns as the stock market. When stocks are down, gold’s physical and monetary value drives investment, which raises its price. During the recent social and political upheavals, gold stood strong while stocks and stock-based investment portfolios took a massive hit. During the first few months of the American pandemic response, the S&P 500 took a 23% nosedive, while gold saw a mere 0.1% dip. Gold prices historically fail to move with other investments, making it a reliably stabilizing factor in your financial future. It even beats Bitcoin as a bulwark against inflation according to Forbes

Do you want to get started investing in gold or other precious metals, either as your primary hedge against future financial volatility or the potential for societal disruption, as a way to control for rising interest rates and home prices, or falling stocks? One of the easiest ways to dip your toe into the water is an expert-curated, highly rated subscription service like Bullion Box. You can get into a monthly gold and other precious metal monthly subscription service at prices that fit most budgets.

If you’re simply curious, or don’t have a lot of disposable income, you can get started for only $59/mo with silver bars and rounds up to 1oz. Expanded monthly plans can be had from $125/mo for even more, rarer silver, or as much as $250-$500/mo for gold, platinum, and even rare collector’s pieces. Whatever your price range, there’s something available. Even if you’re not ready to jump into investing, check out their website for more information about precious metals, their value, and why it might be a good place to put your money in uncertain times.