Let’s start this by saying this is not investment advice. You should never take investment advice from a website that writes about guns—especially from me. I know very little about investing, and my portfolio is all about slowly getting rich through the S&P 500, a good IRA, and CDs while interest rates are high. However, today, I want to propose the idea of investing in gun stocks not as necessarily a means to make money but as a way to significantly contribute to the fight for gun rights.

As far as gun rights go, things are looking good. Like DJ Khaled, all we do is win. This winning in courts and even public opinion is due to the folks at gun rights groups like the GOA, SAF, and even the NRA. Believe it or not, the NRA helped fund a chunk of the brace ban litigation and, last time I checked, paid for half of it. We fight in the courts and even in the court of public opinion, but are we losing ground elsewhere?

The other side, the anti-civil rights side, has been losing left and right. But when you lose, you tend to either give up or get creative. On the other side, they certainly haven’t given up. They’re still in the fight. They’ve gotten creative. They attack firearms from different angles. They attack advertising, use zoning regulations, and use the ATF to kill FFLs for minor paperwork issues. These groups even use organized efforts to attack firearm companies monetarily.

Advertisement — Continue Reading Below

Gun Stocks and The Campaign To Unload

An organization called the Campaign to Unload is a scheme that encourages people and organizations of all sizes to divest from firearms and ammo companies. In fact, it encourages people to divest from any company that has anything to do with firearms. Here is what they say:

Campaign to Unload seeks to end gun violence with a bold new strategy. United with social justice activists and more than 50 organizations, we are hitting back at irresponsible gunmakers where it hurts: their sources of funding. With the help of student activists, the faith community, and civil rights leaders, we continue to grow our movement and fight for safer communities.

Advertisement — Continue Reading Below

This new approach has caught the attention of MSNBC, Huffington Post, New Republic, Boston Globe, and many others, who have called the movement “the new front in the war on gun violence.”

They are fighting on a front I haven’t seen anyone on the firearm side even consider. If we want to preserve our civil rights, we have to fight the anti-civil rights groups at every front. This brings us back to gun stocks. Is purchasing shares of the few public ammo and gun companies a worthwhile way to combat things like Campaign to Unload?

Advertisement — Continue Reading Below

Campaign to Unload has scored some wins. They got the California State Teachers Retirement System to divest from guns, as well as other pension funds in New York and Philly.

Beyond the Campaign to Unload

The Campaign to Unload is focused on divesting, but the Northwest Coalition for Responsible Investment is a group that’s taken a different approach. They work to purchase firearm stocks in large numbers so they can have a say in how firearm companies are run.

Advertisement — Continue Reading Below

They push shareholder initiatives to get gun companies to change how they do business. So far, they haven’t been successful. Another group, the Interfaith Center on Corporate Responsibility, aims to do the same thing: purchase gun stocks to achieve some manner of control over how the business is run.

That doesn’t mean there haven’t been some successes. The largest shareholder of S&W, the ominous and somewhat terrifying Blackrock Inc., demanded that the company answer for the risk that its products cause. Admittedly, a company as large as Blackrock can own 9% of S&W and seem tough to conquer.

Advertisement — Continue Reading Below

Luckily, S&W does own the majority of its company. Still, if every person purchased one share every time they purchased a S&W weapon, it could ideally make a difference.

American Gun Stocks

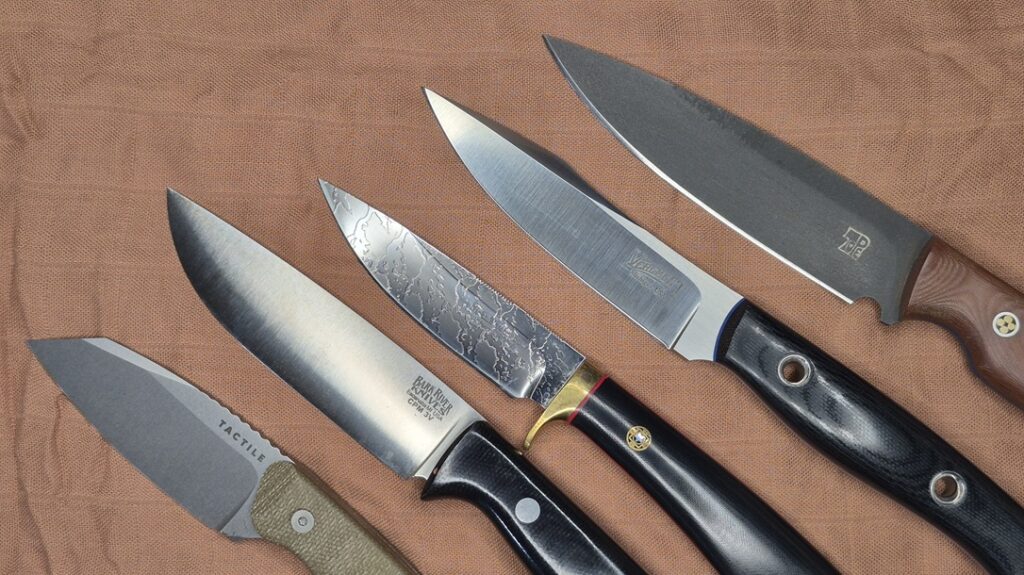

There aren’t a lot of companies that are public. I’m not a huge stock guy, so there might be more, but in searching, I found that S&W, Ruger, Olin, Vista Outdoor, and Ammo Inc. are all public. The price varies, but currently, S&W stock is trending pretty low.

At 15ish dollars a share (subject to change), it’s not a hefty investment. I purchased some, but this isn’t an investment advice. I don’t think my few shares will ever make me rich, but I see it as a small way to stand up to anti-gun groups looking to wage war on our civil rights via financial means. In an era where we fight for braces, 80 percent lowers, against AWbs, and more, we have to consider the financial side of this fight.

Advertisement — Continue Reading Below

Then again, maybe buying ammo is a better investment.